1099 Int Due Date 2024 Calendar Year – It’s tax time. Here’s a look at what you need to know about due dates for your tax forms, including Forms W-2 and 1099, and what to do if you don’t receive yours on time. . Tax Season 2024 the dates you need to know to get you through this tax season. For more on taxes, here’s how to set up an account on the IRS website and what to know about this year’s child .

1099 Int Due Date 2024 Calendar Year

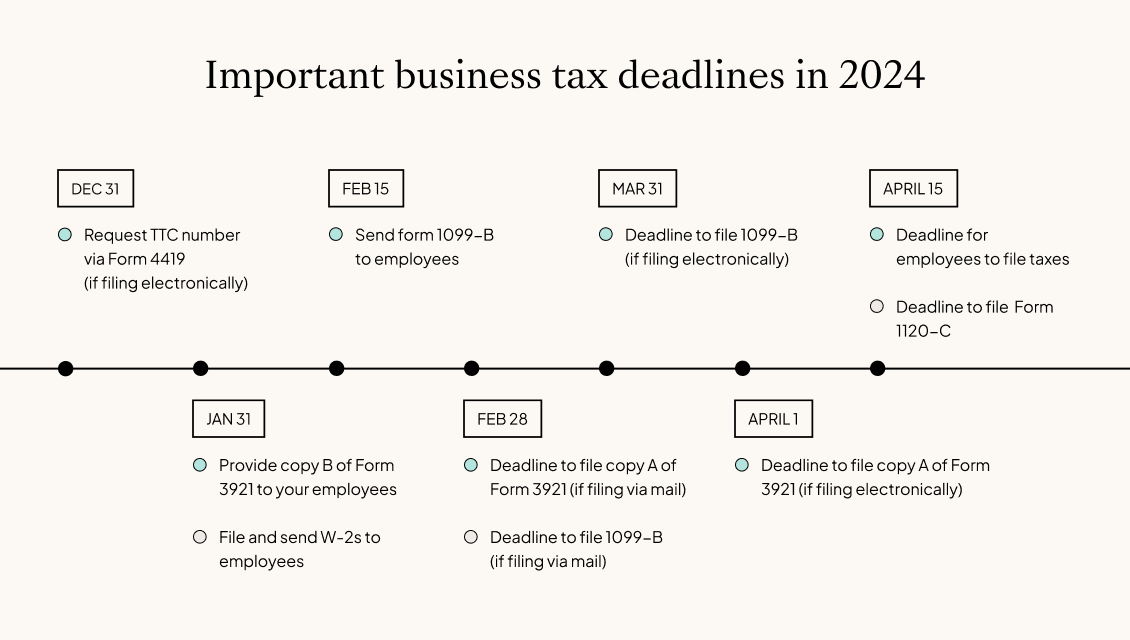

Source : blog.checkmark.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

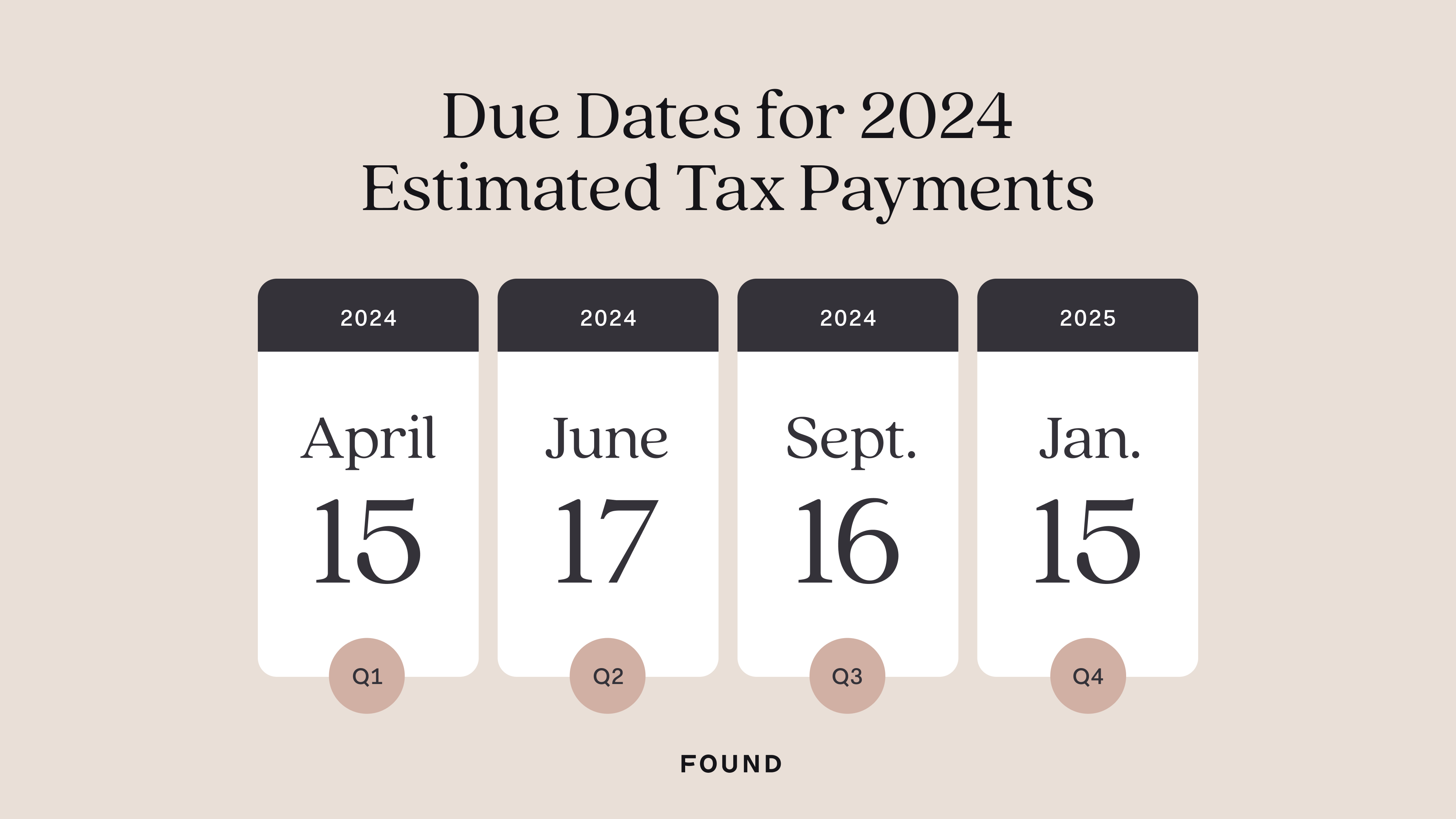

Source : blog.checkmark.com2024 Tax Deadlines for the Self Employed

Source : found.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

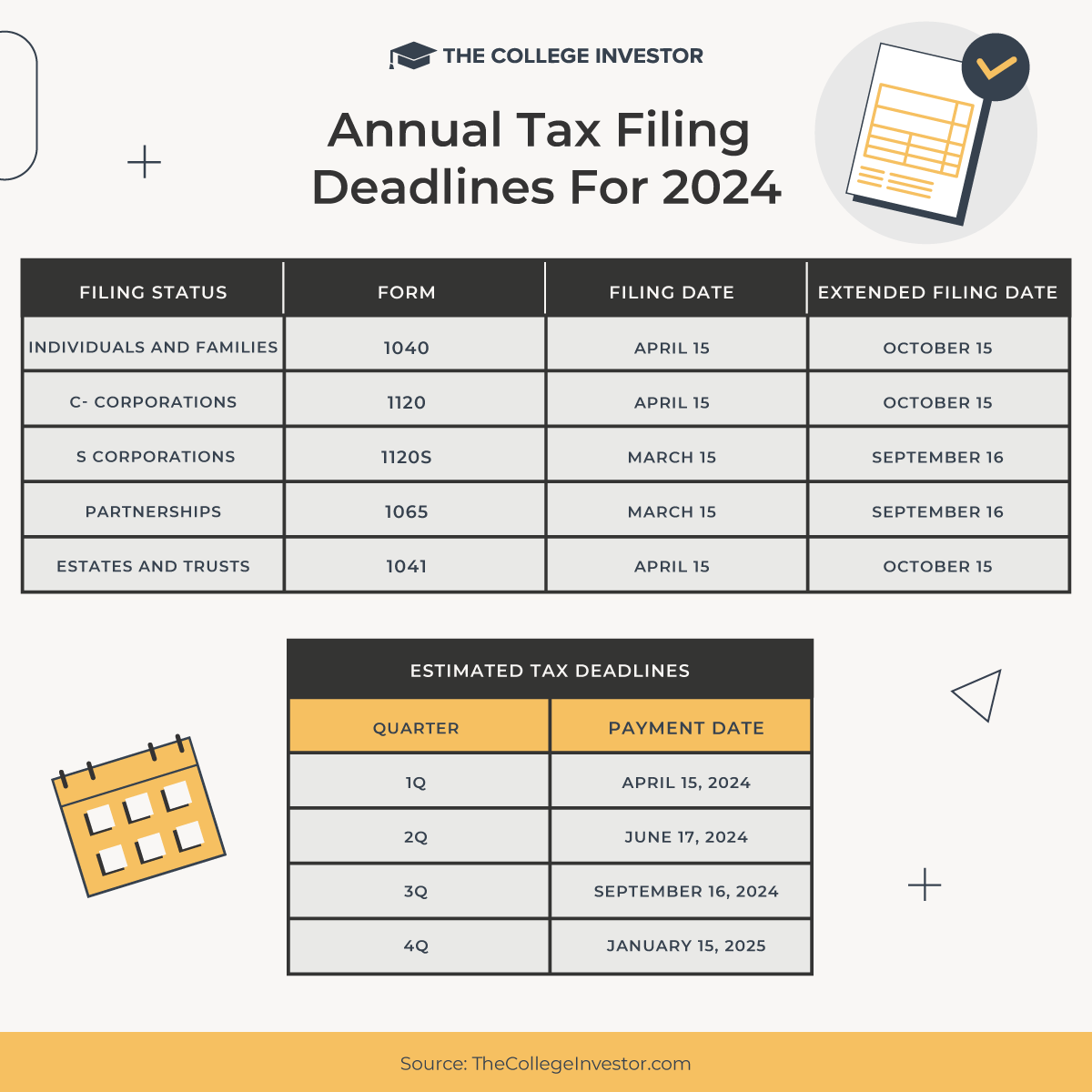

Tax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.comBusiness Tax Deadlines 2024: Corporations and LLCs ECS Payments

Source : www.ecspayments.com1099 Deadlines, Penalties & State Filing Requirements 2023/2024

Source : blog.checkmark.com2024 Q1 Tax Calendar: Key Deadlines for Businesses and Other Employers

Source : www.tgccpa.com1099 Int Due Date 2024 Calendar Year 1099 Deadlines, Penalties & State Filing Requirements 2023/2024: Due Date For 2024 Last Quarterly new $600 reporting threshold for Form 1099-K for third-party settlement organizations until the 2024 calendar year. As the IRS strives to smoothly implement . The 1099-INT will show interest earned on the CD from the date of purchase last year until Dec. 31 income tax rates exist for both 2023 and 2024 federal returns. They are 10%, 12%, 22% .

]]>